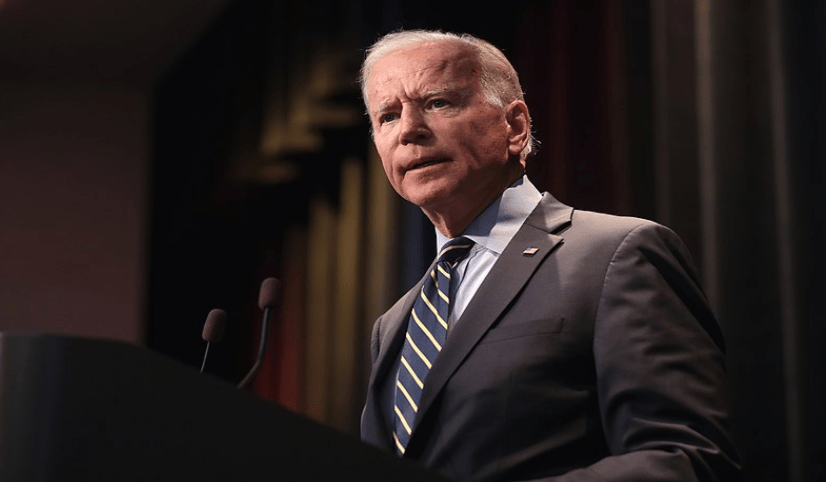

A major tax increase may be around the corner as President Biden plans to show off his brand new infrastructure plan that could surpass $3 trillion in overall costs. Biden’s administration commonly refers to the plan as the ‘Build Back Better’ plan, although his odds of finding as much support for this proposal may be very challenging.

So who’s taxes are going to rise in order to pay for this? Well there’s a good chance that the corporate tax rate will see an increase from 21% to 28% to kick off the tax hike. If you make more than $400,000 per year, then your tax rate may skyrocket to nearly 40% under this proposal. This is probably not positive news for many different corporations that received lower tax benefits under former President Trump’s administration.

The entire Republican party voted against the $1.9 trillion relief package because they believed that government spending is starting to get out of control. You can expect a lot of the same once again with the infrastructure bill, although Republicans will really not be happy to learn that it will have a price tag that is roughly twice as large.

It’s possible that even some democrats within the party could be concerned about the spending of this bill, especially moderate members of congress that don’t want to see taxes increase on a struggling economy.

According to the Biden administration, nobody that makes less than $400,000 will be forced to pay an increase in taxes to support this proposal. There will be tax significant increases to individuals that surpass this amount annually. President Biden already seems to know that he won’t receive any Republcan support for the proposal, but he doesn’t seem to worry about the partisan approach that he’s been taking lately to ensure that his administration’s agenda gets met.

Many moderate democrats spoke to various sources in recent days and many of them indicated that they would not support a corporate tax rate increase to 28%. Some of them indicated that a number between 23% and 25% would be much more reasonable.

Biden traveled to Pittsburgh to share the ideas of the proposal and try to find some layer of bipartisan support to help improve the legislation and find new ideas to make it better. It’s currently unclear if the ‘Build Back Better’ proposal will have enough support to pass both chambers, but it’s currently very likely that at least some amendments will need to be made to the corporate tax rate before an agreement can be had.

Any adjustment to the corporate tax rate could create major problems in terms of balancing the budget of the spending proposal. The corporate tax rate increase to 28% is designed to offset the spending losses within the bill. Without a full increase to 28%, it could get challenging to prevent this infrastructure bill from falling apart.