It was midday on a Saturday, and Simonetta led me from the open front door of her home in southeast Chicago to her sitting room and settled next to her husband, Christopher, on the couch.

In the 1980s, Christopher had worked a few blocks away at U.S. Steel South Works, earning three times the minimum wage with a high school diploma – more than enough to buy a house near Simonetta’s parents before their first baby arrived. Like their neighbors in southeast Chicago, Simonetta and Christopher’s expectations for work and home were set by the steel industry.

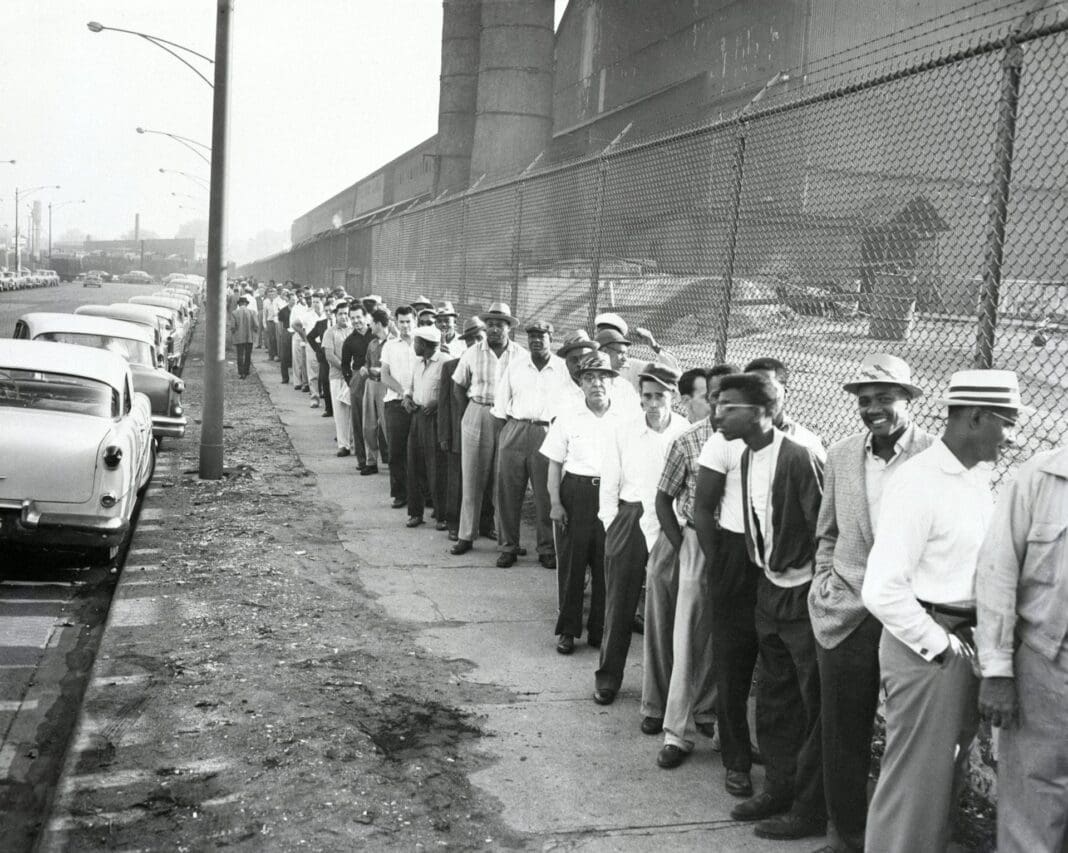

Between 1875 and 1990, the employment offered here by eight steel mills created a dense network of working-class neighborhoods on the marshlands 15 miles south of downtown Chicago. For the tens of thousands of employees who lived and worked in this region, steel was a rare breed of work: unionized, blue-collar jobs that paid middle-class wages, with starting salaries in the 1960s at nearly three times the minimum wage.

Opportunities for promotion, benefits and secure job tenure allowed workers to buy houses, shop at local stores and put away savings. The steel industry was more than just work; it organized the spatial and social relations of this neighborhood.

Its collapse was devastating to people living in the neighborhood, Simonetta told me. As mill after mill shuttered in the last two decades of the 20th century, people began to leave to find new work – mostly service jobs – located far from southeast Chicago’s economic depression.

As we stared at the silent street, I asked them, “Why did you stay?”

Christopher paused, then said simply, “We had the building.” The couple owned their three-story row home outright after decades of paying off the mortgage. Sure, it had some crumbling corners and the roof sagged, but it was theirs. These four walls remained solid during and after the topsy-turvy years of economic collapse. More than just a form of equity or material space, this building was the foundation for their stability.

For the past 10 years, I’ve asked why people stay when their local economy collapses.

In my 2024 book, “Who We Are Is Where We Are: Making Home in the American Rust Belt,” I used ethnographic research and interviews to study the long-term outcomes of deindustrialization in a rural iron-mining community in Wisconsin and urban manufacturing neighborhoods set amid the steel mills of Chicago.

The causes of deindustrialization were macroeconomic and global – technological change, trade deals, environmental regulations and increased competition – but the effects were local. In the second half of the 20th century, towns and cities that grew up around industries that extracted iron and manufactured steel suddenly lost the core of their blue-collar employment.

Stretching from New York to Minnesota, the Rust Belt region has experienced five decades of nearly double-digit unemployment rates. In the wake of industrial closures, hundreds of thousands of unemployed people packed up their houses and sought their fortunes in factories or mines in the American South, or anywhere that wasn’t collapsing from economic depression. In the process, these deindustrialized places not only lost their grip on their residents but their place in the American story of economic progress, growth and resilience.

But not everyone leaves.

For this research, I talked with more than 100 people, like Simonetta and Christopher, to understand why people stay in these neighborhoods as jobs dry up and stores close. Again and again, they argued that their stuckness in place offered them stability in a chaotic world.

The people I spoke with often began their stories with a practical – and economic – concern: the finances and freedoms of homeownership.

For many long-term residents, moving elsewhere was economically impossible. Depressed housing values meant they couldn’t recoup their investments by selling, and the process of moving is itself expensive. Yet they also argued that owning their house offered them a little piece of stability in the early years of unemployment.

In the mid-20th century, good wages combined with federally backed home loans opened avenues of homeownership for blue-collar iron and steelworkers.

Beginning in the 1960s, southeast Chicago transitioned from a majority rental community to one where between 60% and 70% of houses were owner-occupied. For Christopher, Simonetta and thousands of their neighbors, buying a home was a sound financial decision and a path toward achieving the American middle-class goal of building wealth through private property ownership.

Of course, houses are more than simply material investments. Simonetta and Christopher’s house was also their family story. In the first half of the 20th century, Simonetta’s parents had immigrated from Mexico. Christopher’s grandparents had arrived from Mexico at the turn of the 20th century. Simonetta explained that since they had grown up in the neighborhood, when they got married, they wanted to buy a place within walking distance of their parents and webs of aunts, uncles and cousins.

When they made the down payment in 1980, they benefited from plummeting house prices. Wisconsin Steel had just closed its nearby mill, and housing prices in nearby neighborhoods had already dropped by 9%. But they hadn’t expected the whole region’s housing bubble to pop.

Housing prices in their neighborhood began to fall as U.S. Steel slowly laid off workers through the 1980s and 1990s. Even today, the median price of homes listed in southeast Chicago ranges from $80,000–100,000, less than a third of Chicago’s median of $330,000. When the neighboring mill closed, their family networks were stuck.

Simonetta recalled, “My father, my parents still lived in the neighborhood. They weren’t going anywhere. Where were they going to go?” She continued, “It’s not like we’re rich. I mean, the mill’s closed. We were unemployed!”

Even if their parents wanted to sell their house and start a new life in a more promising location, selling in the economic free fall of deindustrialization would have cost them too much. Mass unemployment turned homes that were once sound financial investments into nearly unsellable liabilities.

Even while the economics of homeownership limited options, owning property was also a haven when everything else was in turmoil. Having “the building,” as Christopher called their house, made their path forward simple: Put food on the table by doing odd jobs and commuting an hour-plus to the suburbs, and look out for each other.

Home is also where family, socially constructed identities and familiar experiences coalesce. The people I spoke with drove me to their favorite lakes and parks, sketched maps to their beloved shops or hiking paths, and pointed out historical markers of industrial pasts. They celebrated the social networks that still anchored their identities in place – extended family, annual parades and regular school and work reunions.

Interviewees were quick to admit that the sprawling crisis of deindustrialization constrained choices and limited their options. But within the fractured scaffolding of postindustrial social life, a generation of long-term residents still belong to one another.

“We survived, and that’s why we didn’t leave,” Simonetta said. “The community has changed, but where else are we going to go? I mean, we’ve been here for fifty-something years. … This is my neighborhood.”

“That’s how you destroy neighborhoods,” Christopher interjected, “by leaving!”

This article is republished from The Conversation, a nonprofit, independent news organization bringing you facts and analysis to help you make sense of our complex world.

Read more: Revisiting Middletown, Ohio – the Midwestern town at the heart of JD Vance’s ‘Hillbilly Elegy’ As the coal industry shrinks, miners deserve a just transition – here’s what it should include

Amanda McMillan Lequieu does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.