Inflation figures released on Feb. 12, 2025, will come as a disappointment to Americans who hoped President Donald Trump would be true to his word on bringing down prices “on Day One.” It will also put pressure on the new administration to be wary of policies that may heat up inflation – and that includes tariffs.

The consumer price index, which measures the change in prices paid by consumers for a representative basket of goods and services, rose unexpectedly from December to January by 0.5%. It means consumers are paying around 3% more on item prices than they were a year ago.

Economists had been expecting the pace of inflation to slow in January.

The news isn’t good for anyone concerned. It means inflation remains above the Federal Reserve’s long-run target of 2% – making it harder for the central bank to cut rates at its next meeting on March 19. At its last meeting, the rate-setting Federal Open Market Committee kept its benchmark federal funds rate unchanged at a range of 4.25-4.50%.

Following the release of the latest inflation data, markets have a stronger conviction that the Fed will again hold rates steady when it meets in March.

It also means more pain for consumers. Higher interest rates set by the Fed play a large role in determining rates for mortgages, credit cards and auto loans. If January’s rate of inflation were to continue throughout 2025, consumers would see a painful 6.2% annualized inflation rate.

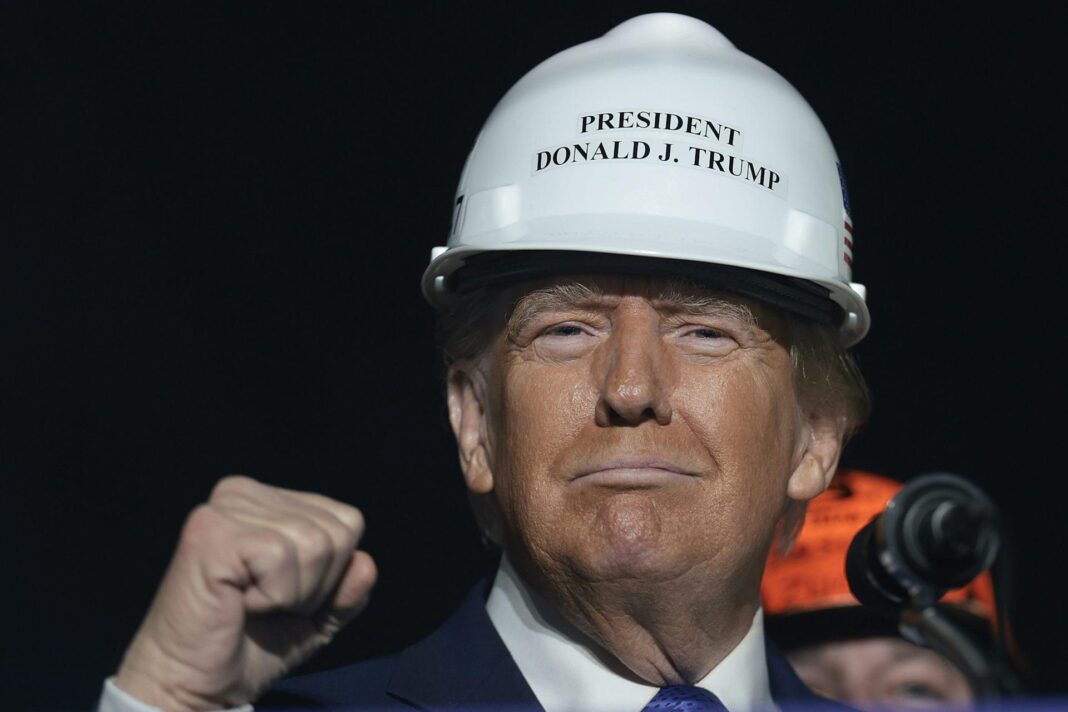

And although it would be churlish to link the latest jump in inflation to an administration just weeks old, it does put into focus the current slate of Trump economic policies. Economists have long warned that imposing tariffs on imports and cutting taxes does little to curb inflation – rather, they may contribute to faster price increases.

Already, China has been hit by a 10% tariff on all products. Trump has also proposed a 25% tariff on all steel and aluminum imports, and he mulled imposing new tariffs on Canada and Mexico – two of the United States’ largest trading partners.

I believe that if these wide-ranging tariffs come into effect, the Federal Reserve will have no choice but to keep rates elevated for the remainder of 2025.

One of the largest drivers of inflation in January was rent increases, which accounted for nearly 30% of all items increase. Rents jumped 4.6% from a year earlier.

If Trump’s tariffs on Canadian imports, like lumber, take effect, Americans can expect continued price increases in the homebuilding sector. Supply and demand imbalances remain a key driver for higher prices, so fewer houses being built due to higher materials cost will likely lead to higher rents.

Consumers saw better news on new vehicle prices, which remained flat over the month and showed slight declines from a year ago.

This is even as demand for new cars increased 2.5% over 2024. In January 2025, the number of new vehicles sold topped the same month a year earlier for the fifth month in a row.

But as with homebuilding, any tariffs on the import of car parts or materials will impact the auto industry. Carmakers may have breathed an immediate breath of relief when Trump delayed new tariffs on Canada and Mexico. But if deals aren’t reached by the March 1 deadline, industry analysts expect immediate impacts on top sellers.

And any higher cost of new cars will have a knock-on effect on used cars, which saw prices jump 2.2% in January – it’s largest increase since May 2023.

Of course, not all inflationary pressures are in the purview of government.

The transportation sector, which includes insurance and parking fees, increased by 8% over the year. Insurance prices soared almost 12%, on the back of last year’s 20.6% increase in prices, while parking fees increased by almost 5% as a result of more expensive repairs and more dangerous driving behaviors.

Meanwhile, with bird flu continuing to spread, egg prices rose a shocking 15.2% in January, and are 53% more expensive than at this time last year.

All in all, voters who cited inflation as the main reason they were backing Trump may be feeling a little uneasy – the administration is only a few weeks old, but for one reason or other, Americans are experiencing ever higher prices with little relief in sight.

This article is republished from The Conversation, a nonprofit, independent news organization bringing you facts and trustworthy analysis to help you make sense of our complex world. It was written by: Jason Reed, University of Notre Dame

Read more: Soaring inflation helped lead Trump to victory – here’s why some of his policies might drive prices higher again Trump’s opening tariff salvo will hurt US consumers − following through on Canada, Mexico threats will increase the price pain Why federal courts are unlikely to save democracy from Trump’s and Musk’s attacks

Jason Reed does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.